Strategic Acquisition Opportunity: Finixia Dedecons Pvt. Ltd.

1. Introduction

Finixia Dedecons Pvt. Ltd. presents a strategic opportunity for investors or technology firms seeking to acquire a fully incorporated Indian IT services entity. The current shareholders are offering a 100% equity stake transfer, providing the acquirer with complete control over the company’s operations, brand assets, and existing financial framework.

2. Company Overview

Incorporated in 2023, Finixia Dedecons Pvt. Ltd. operates as a service-based IT solutions provider. The company is structured to deliver digital transformation services, including software development, IT consultancy, and technical support. The business model is asset-light and service-oriented, minimizing operational overheads while maximizing delivery efficiency.

3. Market Position

The company is positioned to serve the expanding Small and Medium Enterprise (SME) sector in India and international markets. By focusing on essential IT infrastructure and digital services, Finixia Dedecons addresses the critical digitization needs of growing businesses. The current operational structure allows for immediate scalability, enabling the new ownership to pivot or expand service lines with minimal friction.

4. Financial Highlights

The company operates on a high-margin, service-based financial model.

-

Revenue Projection:

-

Annual Revenue (FY 2024–25 – Projected): ₹25,00,000 (≈ $30,120 USD)

-

-

Business Model: Service-based revenue generation with low capital expenditure requirements.

-

Liabilities: The company maintains a transparent balance sheet suitable for due diligence.

5. Business Strengths

- Clean Corporate Structure: Private Limited entity compliant with Indian Companies Act, 2013.

- Scalability: Established framework ready for rapid team expansion or service diversification.

- Operational Readiness: Existing workflows and digital infrastructure in place for immediate takeover.

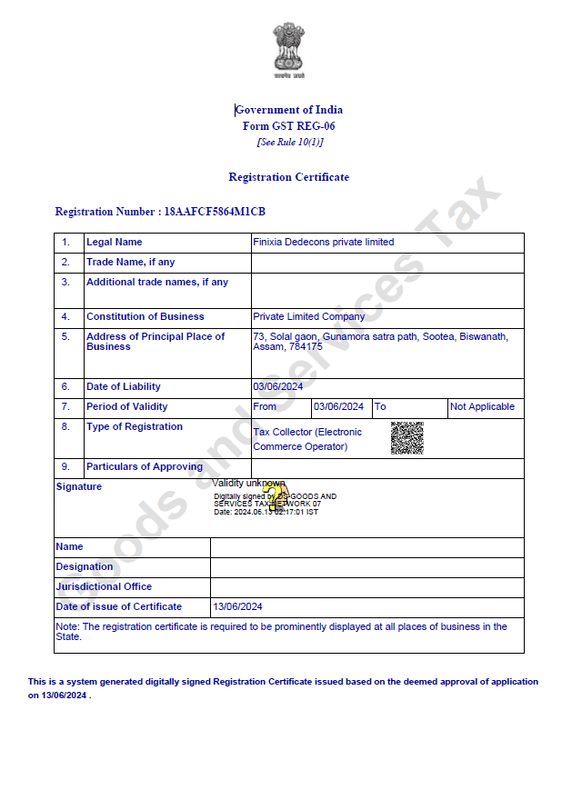

- Compliance Adherence: Fully compliant with GST and statutory filing requirements.

Reason for Sale: The promoters are divesting to focus on non-competing ventures in a different geography. This sale offers a clean entry point for a buyer to acquire a debt-free, compliant Indian IT entity without the setup lead time.

6. Acquisition Details

This transaction involves the complete transfer of the business entity.

-

Ownership Transfer: 100% Equity Stake.

-

Asking Valuation: ₹75,00,000 – ₹1,00,00,000 (≈ $90,000 – $120,000 USD).

-

Transaction Scope: Includes all assets, liabilities (if any), and intellectual property.

Transition Support: The current management is committed to a 30-day handover period (included in the valuation) to ensure a smooth transfer of bank accounts, client relationships, and administrative access.

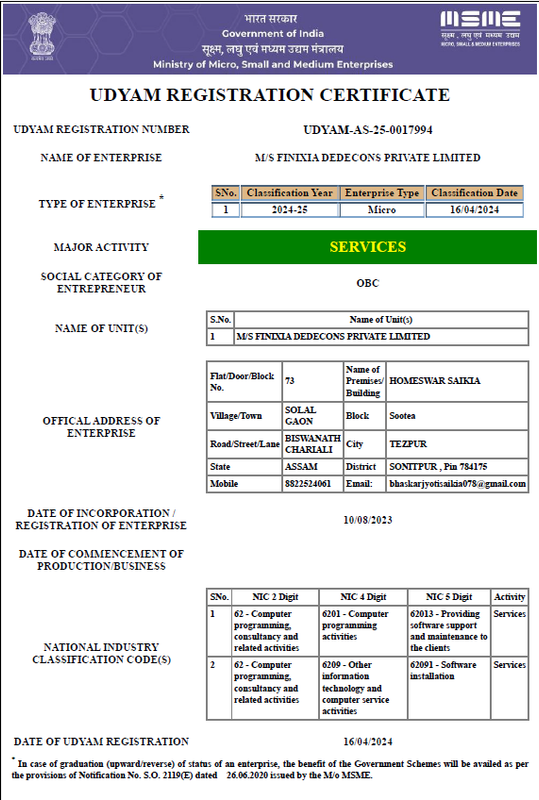

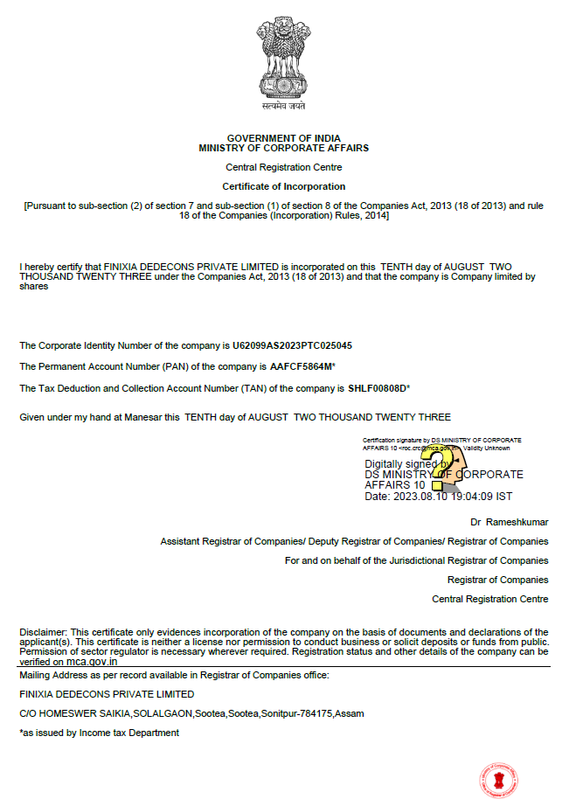

7. Legal & Registration Documents

The following statutory documents verify the legal standing of the entity.

8. Assets & Digital Properties

The acquisition includes full transfer of the following assets:

-

Registered corporate brand and associated intellectual property.

-

Primary company domain names and website source code.

-

Social media handles and digital marketing accounts.

-

Client databases and vendor contracts (where applicable).

9. Confidentiality Notice

The information provided herein is for preliminary review purposes only and is subject to verification during the due diligence process. Financial projections for FY 2024–25 are estimates based on current business trajectories. This document does not constitute a binding offer to sell until a formal Share Purchase Agreement (SPA) is executed. All inquiries will be handled with strict confidentiality.

Next Steps: Serious inquiries are invited to review the preliminary data. Please contact the undersigned to request the Non-Disclosure Agreement (NDA) and access the Virtual Data Room (VDR) for full financial due diligence.

Contact: +919127082397 (Bhaskarjyoti Saikia, Managing Director of Finixia dedecons private limited Email: bhaskarjs.md@finixia.in